All Eyes Are On Ukraine

Originally published on February 24, 2022.

All eyes are on Ukraine. As the crisis unfolds, weak markets are accelerating to the downside. For already weary investors, the expectation in the short term should be for the stock market to remain volatile.

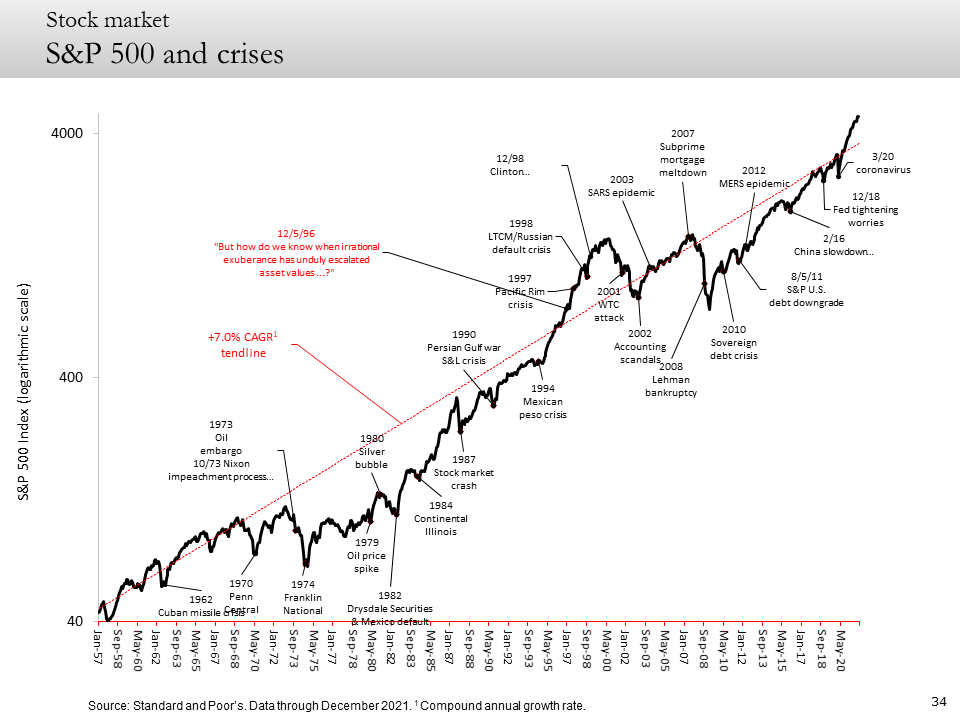

Though the news from Ukraine is coming in quickly, it can make sense to slow down and take a step back before making an investing decision. What can we learn by charting numerous other crises through history?

Image from Fritz Meyer POV Economy-Markets-Investment Strategy, January 2022Financial markets are resilient. At least in a financial sense, most crises are acute and short-term. In the long run, markets heal and move on.

Despite this, the fear of a stock market crash runs deep, and it can affect even the most experienced investors. People who bought stocks in October 2007 and sold them in March 2009 lost more than 50%.

Between Oct 2007 and Mar 2009 (the yellow arrow), the S&P 500 dipped over 50%. Markets recovered and went on to gain 173% as of Feb 23, 2022. Retrieved from Yahoo! Finance, Feb. 24, 2022. At that time, it seemed like a huge mistake to have purchased stocks in 2007. For a lot of people, it felt better to sell rather than hold through a crisis. But by giving the markets time, investors who bought the S&P 500 in October 2007 and have them today are still sitting on a +173% gain. During those 15 years we worked through a global financial crisis, several political and geopolitical upheavals, a global pandemic, and two recessions.

Crises come and go, and they will continue to come and go. The most effective investing strategy in this inevitable cycle is patience. With patience, you don’t need to be a geopolitical expert, an economist, a daytrader or a fortune teller. Patience has always worked.