Fully Invested.

Newsletter articles and blog posts to help you navigate the markets.

Hitting the Pause Button

Uncertainty in the markets could continue to churn in the near term, and that makes it especially hard to plan for the future with confidence. How can we deal with near-term risk and still constructively invest for long-term growth? I've put together a very simple framework that helps me cut through the complexity of current events.

Originally published on April 24, 2022.

2022 was supposed to be the year that we could start recovering from the pandemic and finally move on with life. Instead, we’re dealing with war, inflation, and the most volatile markets we’ve seen in years. The sudden change in market conditions, driving down both bond and stock prices, caught even the most savvy pros flatfooted.

In this kind of environment, sometimes it helps to take a step back and hit the pause button. Find a way to make things simpler, not more complicated. Filter out the noise and complexity and consider your investment needs in their simplest terms.

One simple planning approach is to break things down into two straightforward categories:

Money I know I’ll need in the next 2 years; and

Money I know I can set aside for 10+ years.

Let’s explore each.

Live to Fight Another Day: Cash and Cash-Like Options for 2022-2023

If you think about the next two years, how much cash do you need for expenses and purchases? How much do you want in your emergency fund? How much for a “safety blanket?” This is the amount to set aside in cash or cash-like investments.

Cash is the ultimate stable asset. If held in an FDIC-insured account, there is no chance of losing money. No matter what the stock market does, your cash will be constant. For people who need or want to hold a lot of cash, the good news is that rates on FDIC-insured accounts like high-yield savings and CDs are finally going up.

Online banks like Ally and Marcus already pay 0.50% APY on high-yield savings accounts, and those rates should automatically adjust upward as the Fed raises rates. As of April 22, 2022, a 9-month non-callable CD issued by Goldman Sachs is at 1.1%, and a 2-year non-callable CD issued by Goldman Sachs is at 2.6%. These rates might continue to tick up, but they are high enough that we’ve started buying them for certain clients.

I Bonds at TreasuryDirect.gov continue to be compelling. They currently pay an annualized rate of about 7%, and the rate will adjust every six months based on inflation. You’re capped at $10,000 per person per year, and the bonds can’t be liquidated for the first 12 months, but nevertheless they are a great option for most people. (For more details, see our December 2021 post.)

Finally, a creative option for homeowners with a lot of equity is to put in place a home equity line of credit (HELOC), but not necessarily use it. Having access to equity without needing to sell your home can give peace of mind for all the “what ifs” that creep into our minds during turbulent times.

The calculations to determine your desired cash reserves should be pretty straightforward. Once you have a plan for the amount you want to keep safe today, then it’s time to think about your future self.

Stocks for 2032 and Beyond

With stocks experiencing massive volatility, is it time to get more conservative? I’m inclined to say that for investments that can be held for 10+ years or longer, the answer is “no.”

If inflation runs at 4-5% and safe assets only return 2-3%, you are locking in an inflation-adjusted loss. That may be okay for the next few years, depending on your risk tolerance and employment status. But over longer periods of time, your goal should be to exceed inflation to maintain your standard of living over your lifetime.

Inflation – and the interest rate increases expected to battle inflation – is taking a toll on the stock market. Over the past year, the S&P 500 is up barely +3%, and the tech-heavy Nasdaq is down over -4.6%. This is consistent with previous periods of high-inflation. And if high inflation persists (5%-plus annualized), we can expect the struggle to continue. In those environments, stocks have barely outperformed the rate of inflation.

Source: CFA Institute, July 2021But there could be an upside. For instance, look at the green bar, which shows inflation regimes that average between 0-5% annually. If inflation today is north of 8%, but is widely expected to come down to 4-5% by the end of the year, we could quickly end up back in an environment where the outlook for stocks is much, much better. If your long-term money is in stocks, you’ll be on that train when it leaves the station.

While these are challenging times for markets, we’ve experienced challenges in the past. Markets have weathered higher inflation. They have weathered world wars and recessions. And yet, the stock market has delivered relatively high returns over the long run. If the future is similar to the past, stocks could double every 7-10 years, give or take a year. If cash averages about 2% per year, it would take 35 years to double.

If you have more than 10 years to wait – and have sufficient cash to wait – which would you rather have?

Next Steps: Adjusting Plans and Carving Out Cash

Something I’ve been telling folks is that it’s possible to be both a short-term pessimist and a long-term optimist. By bifurcating your portfolio in such a way to provide short-term stability in cash and long-term growth in stocks, you can have confidence that your short-term self and your long-term self are both well cared for.

This market continues to be a challenge, and there is no real clarity in the short term. If you do choose to seek refuge in safer assets, talk through the implications to your long-term plan with your financial advisor.

All Eyes Are On Ukraine

The news of war in Ukraine is being digested by global markets. While we continue to focus on the long-term, we’re steeling ourselves for continued volatility as the crisis unfolds.

Originally published on February 24, 2022.

All eyes are on Ukraine. As the crisis unfolds, weak markets are accelerating to the downside. For already weary investors, the expectation in the short term should be for the stock market to remain volatile.

Though the news from Ukraine is coming in quickly, it can make sense to slow down and take a step back before making an investing decision. What can we learn by charting numerous other crises through history?

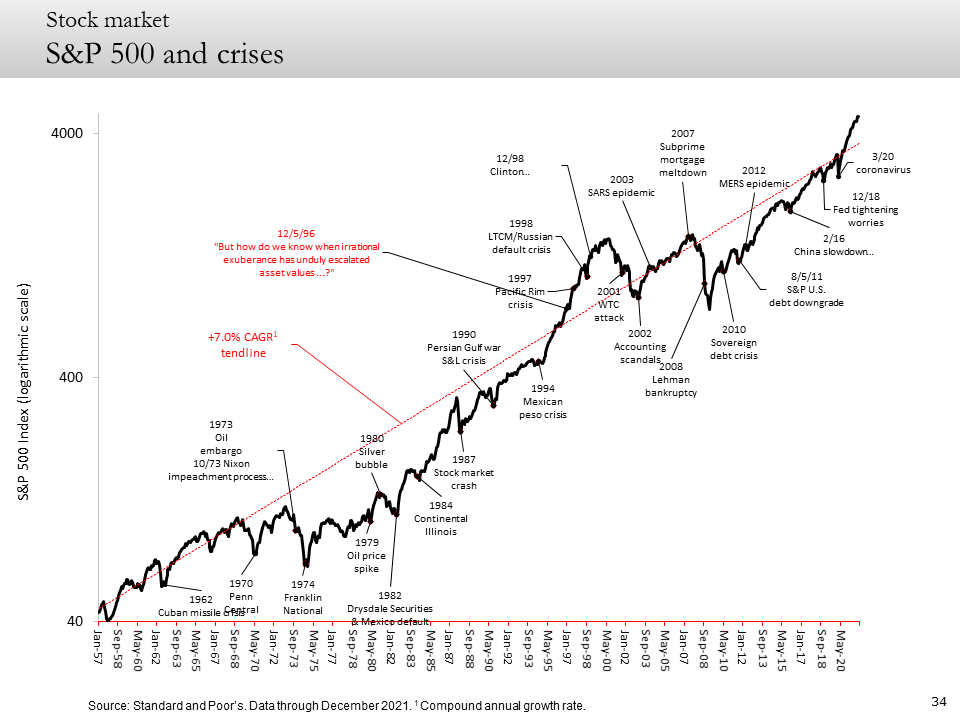

Image from Fritz Meyer POV Economy-Markets-Investment Strategy, January 2022Financial markets are resilient. At least in a financial sense, most crises are acute and short-term. In the long run, markets heal and move on.

Despite this, the fear of a stock market crash runs deep, and it can affect even the most experienced investors. People who bought stocks in October 2007 and sold them in March 2009 lost more than 50%.

Between Oct 2007 and Mar 2009 (the yellow arrow), the S&P 500 dipped over 50%. Markets recovered and went on to gain 173% as of Feb 23, 2022. Retrieved from Yahoo! Finance, Feb. 24, 2022. At that time, it seemed like a huge mistake to have purchased stocks in 2007. For a lot of people, it felt better to sell rather than hold through a crisis. But by giving the markets time, investors who bought the S&P 500 in October 2007 and have them today are still sitting on a +173% gain. During those 15 years we worked through a global financial crisis, several political and geopolitical upheavals, a global pandemic, and two recessions.

Crises come and go, and they will continue to come and go. The most effective investing strategy in this inevitable cycle is patience. With patience, you don’t need to be a geopolitical expert, an economist, a daytrader or a fortune teller. Patience has always worked.

Market Pullbacks

The markets are in the middle of a pullback, and while it can feel like unprecedented times, the truth is that declines like this happen fairly frequently.

Originally published on January 25, 2022.

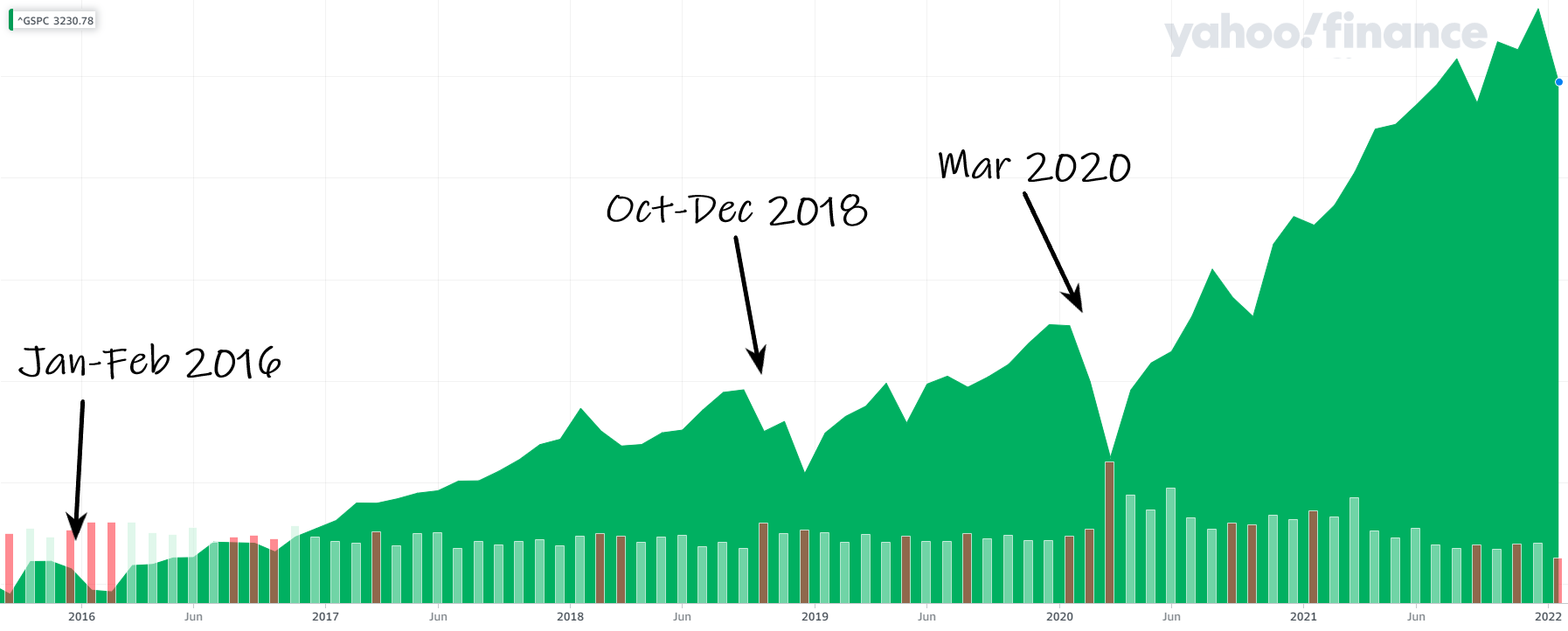

The markets are in the middle of a pullback, and while it can feel like unprecedented times, the truth is that declines like this happen fairly frequently. For those of you who have followed Black Barn since the beginning, we've weathered 20-35% declines in January-February 2016, October-December 2018, and of course March 2020. A pullback in 2022 doesn't seem so wild when you put it in historical context.

By looking back, we can see the result of sticking with stocks through those three declines. Including all three major declines, the stock market still managed to more than double:

There have been quite a few market declines since 2016. Six years later, the S&P 500, a common proxy for the stock market, has grown by over 115%.When the markets take a dive, it's not easy to stay invested. But by sticking to the investing plan through thick and thin, you put yourself in position to compound your wealth at a much higher rate than you otherwise would have by playing it safe in cash.

Series I Bonds - The Perfect Stocking Stuffer?

For those of you looking for higher yields on your cash or cash-like holdings, read on for more details.

Originally posted on December 14, 2021.

Why this savings bond might be the perfect stocking stuffer

As you know, I don’t often talk about bonds, especially in the recent era of extremely low yields. But thanks to the recent high inflation numbers brought on by strong demand and tight supply, a special type of U.S. savings bond is one of today's hottest investments. It’s hard to believe, but it's true. Just last month, investors spent $1.312 billion on one particular type of savings bond -- the Series I savings bond. The demand was likely higher, but the US Treasury limits the amount people can buy.

Bonds are key to a balanced portfolio. They are especially important as you near retirement because in general, they are less risky than stocks. But owning a regular fixed-income bond is tricky right now. For one thing, inflation is starting to tick up.

Rising inflation is a problem for fixed-income investments. For instance, investors will end up losing money on a regular ten-year bond with a 1.9% interest rate if the inflation rate is higher than 2%. Series I bonds, however, offer protection against rising inflation. And there is probably no time better to own a Series I bond than now.

Right now -- and through April 20, 2022 -- investors can get a Series I bond paying 7.12% interest. Better yet, if inflation continues to rise, this bond's interest payments will also rise. While there is an annual limit of $10,000 per person, if you act before New Year's, an individual can purchase up to $20,000 worth of Series I bonds in less than a month.

The best source of information is on the US Treasury's website. Meanwhile, here are some helpful details:

Yield: I Bonds bought between now and April 30, 2022 will start with an annual yield of 7.12%. Every six months, the yield will be adjusted based on a combination of the prevailing fixed rate and the inflation rate.

Limits: One person can invest a maximum of $10,000 per calendar year in Series I bonds. There is no limit on household ownership, so each person within a household can purchase up to $10,000. Also, since the limit is based on a calendar year, each person can purchase $10,000 worth of the 7.12% Series I bonds in December and another $10,000 in January. For those with lower investment amounts, Series I bonds can be bought in denominations starting at $25.

Maturity: Series I bonds mature in 30 years, but they can be redeemed after 12 months. If redeemed between one year and five years, investors will have to forfeit three months of interest. Bonds that are redeemed after five years retain full interest.

Taxes: Interest on the Series I bond is not taxable at the state level (for those of you non-Texans who have a state income tax). It is, however, taxable at the federal level. Taxpayers have the option of paying taxes on the interest annually or deferring the taxes on the total interest when the bond is redeemed or matures. So, if you are working now, you may want to defer the taxes on the total interest payments until after you retire.

Availability: The Series I bond is not offered by brokerage firms or banks. They must be purchased directly through the US Treasury. But a 7.12% bond is probably worth opening one more account.

Stay in Stocks and Keep Your Sanity

Tech stock volatility has received a lot of press coverage in 2021. The tech-heavy Nasdaq index hit new all-time highs four times this year. Every time it hits a new high, the news covers it with bells and whistles. Every time it falls off that high and comes a tiny bit back down towards earth, you hear sirens and alarms.

Tech stock volatility has received a lot of press coverage in 2021. The tech-heavy Nasdaq index hit new all-time highs four times this year. Every time it hits a new high, the news covers it with bells and whistles. Every time it falls off that high and comes a tiny bit back down towards earth, you hear sirens and alarms.

After reaching new all-time highs in February, market-watchers lamented the March tech dip. Then tech bounced back and hit new all-time highs again in April. Now tech stocks are in the doghouse again for falling off those April highs.

All of this comes after a record-shattering run for tech stocks that started last April and continued through February.

So, let's zoom out and look at the broader trends. If you look at a chart, there are four basic takeaways:

1) Between early 2017 and early 2020, the Nasdaq basically doubled.

2) The Covid crash caused it to fall by roughly a quarter in March 2020.

3) From April 2020 through May 2021, it basically doubled again.

4) Over the last five years, the Nasdaq has roughly tripled in value despite one of the worst financial crashes in history.

So what does all this mean for your portfolio? Where do tech stocks go from here? Are they overvalued?

Analysts point to different reasons that could explain why the tech sector is cooling off, if the current dip turns out to be a true cooling off period and not just typical volatility.

Some of the reasons are very straightforward. The pandemic is slowly unwinding and many people around the world are doing more of the things they did in the old days. That could mean that companies that profited from quarantining, social distancing, and tele-commuting could see lower profits as people resume their old habits of commuting to work, taking vacations, and going to ball games.

Some of the reasons are very complex. Changes to banking rules regarding the tier 1 capital ratio that were made in March 2020 were allowed to expire at the end of March 2021, forcing many banks to sell certain bonds by the end of the quarter. This had clear ramifications for both the stock and bond markets, as prices for both bonds and growth stocks fell. Establishing clear cause-and-effect relationships is interesting in hindsight, but very difficult in real time for investors contemplating major moves based on short-term developments.

Longtime readers know my opinion that, unless you are a professional day-trader, you should not try to time the market.

When prices fall, it's natural to ask the question, "Will my tech stocks be worth less next month than they are today?" If you think the answer is yes, you may be tempted to sell.

But a more helpful perspective is to ask yourself, "Have the tech companies I'm holding successfully innovated and earned profits over the last five years? Are they well-positioned to continue doing so between now and when I'm planning on retiring?"

If you think the answer to these questions is yes, then you shouldn't worry too much about the stocks' price next month. You should just remember to keep an eye on corporate earnings as you monitor your investments over the long-term.

The Only Rule of Investing

It's hard to reflect on an experience when you're in the middle of it. But the pandemic has been with us long enough to finally teach me something. Last month brought the one year anniversary of the pandemic. Our lives changed instantly and profoundly, and we'll be telling stories about life under quarantine to our grandchildren. But with vaccines now widely available, we may be close to getting something of our old lives back.

It's hard to reflect on an experience when you're in the middle of it. But the pandemic has been with us long enough to finally teach me something. Last month brought the one year anniversary of the pandemic. Our lives changed instantly and profoundly, and we'll be telling stories about life under quarantine to our grandchildren. But with vaccines now widely available, we may be close to getting something of our old lives back.

Personally, I'm starting to actually feel the pandemic experience passing. It's strange, like I've been in a submarine for a year with no captain and no information on when we might surface. Now I feel like we're finally coming up. Of all the thoughts and emotions this change has brought, I was most surprised by a simple observation I had about investing. In a way, the pandemic has simplified my philosophy to a familiar, three-syllable sound bite.

Just do it

No, I'm not joking. And I'm not being glib. This is it. I know what you're thinking: How can a 30-year old tagline for selling sneakers be my new investing philosophy? Simple. Take a look at what the S&P 500 has done over the last five years. Source: Google news

The S&P 500 has nearly doubled since April 2016. Just a quick reminder that during this time period:

- The Covid crisis paralyzed parts of the global economy...

- A U.S. president hinted that he might not abide by the results of a presidential election...

- Insurrectionists stormed the U.S. Capitol...

…and what did the markets do? They kept bouncing back. If you invested in the most basic ETF for the S&P five years ago, you would today have roughly twice as much as you put in. If you invested in that ETF at any point in the last five years, you would now have more money than you put in. The only way you would have less than what you put in is if you invested during a peak in that graph above and then bailed during one of the dips. So maybe I need to flesh out my new philosophy a tiny bit:

Just do it -And then leave it alone

I believe in the power of the markets. If you are going to invest, you need to believe in the power of the markets. Part of that power you need to believe in is the markets' ability to bounce back. In the last 20 years the markets have bounced back from the Covid crisis, the Great Recession, and 9/11. That's not a bad track record.